Case Studies

...to show you how to take Your Investor Marketing to New Levels

Case Study #1

ABOUT CLIENT

- Industry: Healthcare/Biotechnology

- Exchange: NASDAQ [Symbol: email us for full casestudy]

- Size: Small-Cap

CAMPAIGN

- Type: High-Level

- Purpose: Raise/Stock Split

- Ave Monthly Spend:Varies

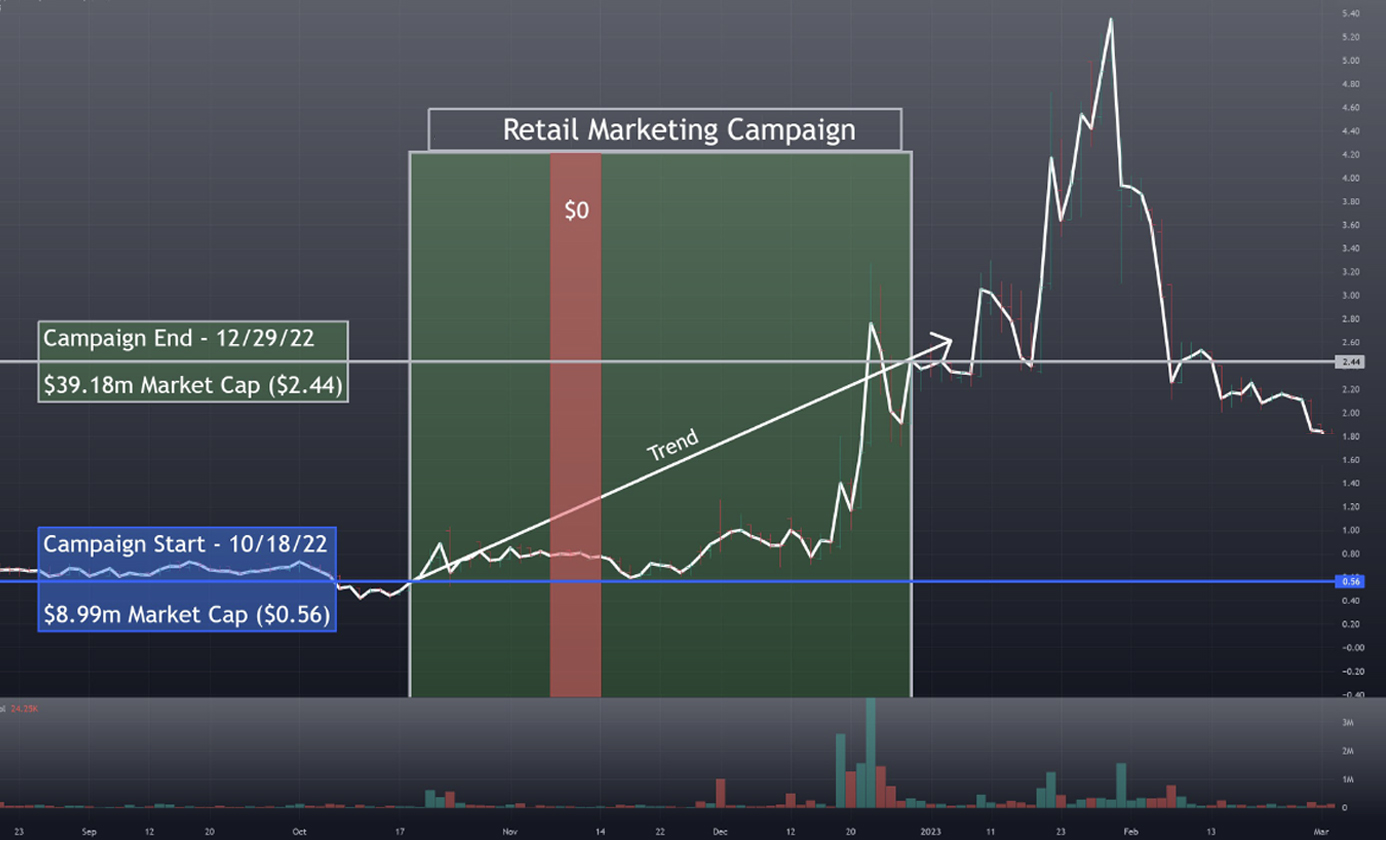

- Campaign Span: Aug 1, 2024 – Present 2025

ENGAGEMENT TYPE

- Service: Retail Investor Marketing

- Term: Ongoing Campaign

- Client: New Client

KEY METRICS

- Market Cap: Start $10.12mm / Current $32.67mm

- Average weekly volumes*:

3.2M

Shares Outstanding: 1.94M

Float: 1.3M

CAMPAIGN NOTES

- Company stock was at average $6.90 (+/- $6.40) for three months previous to the start of the retail marketing campaign.

- From 1,500 to 20,000 new investors

- Raised $20M

- Stock Split 08-20-2024 1:15

- Press Releases: 3x/mo

- Working closely with IR Firm on PR:Yes

CASE STUDY # 1 CAMPAIGN CHART

Case Study #2

ABOUT CLIENT

- Industry: Medical Services & Products

- Exchange: NASDAQ [Symbol: email us for full casestudy]

- Size: Small-Cap

CAMPAIGN

- Type: High-Level

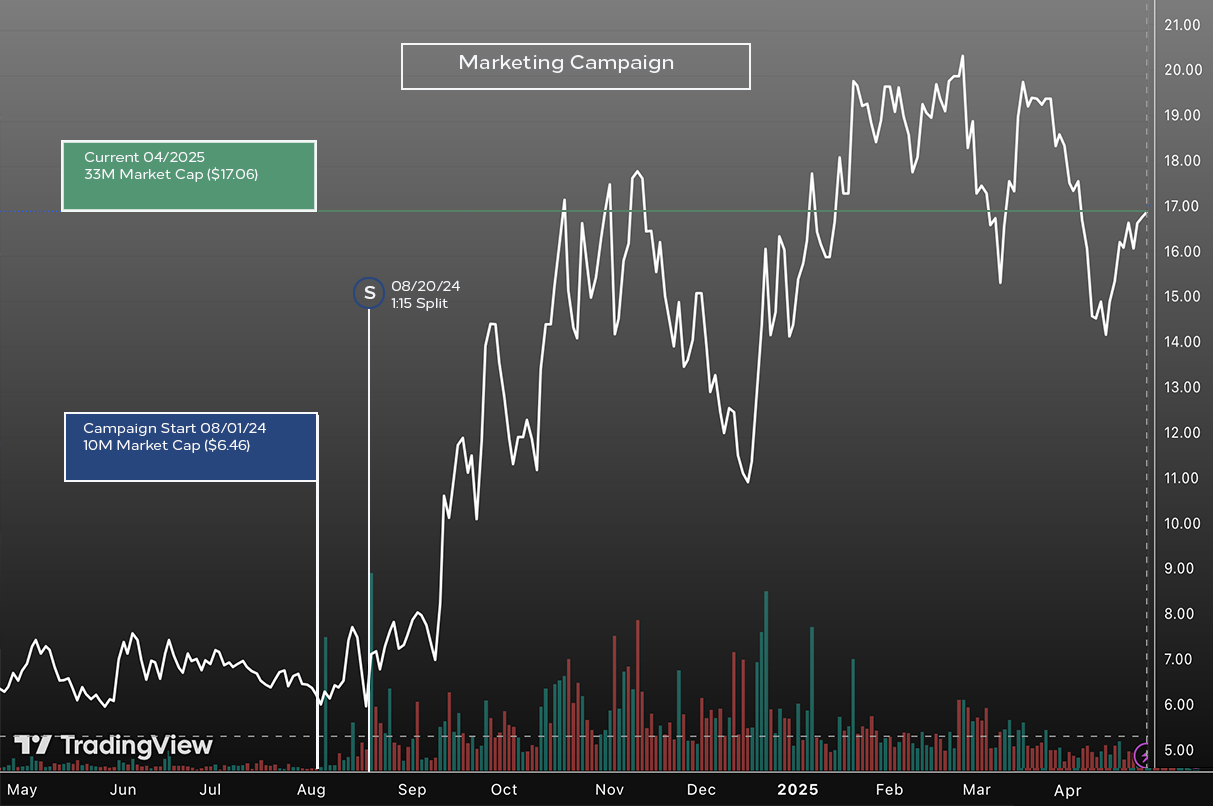

- Purpose: Uplisting (OTC – Nasdaq)

- Ave Monthly Spend:$250k ($50k–$100k per wk)

- Campaign Span: Oct 17, 2022 – Dec 23, 2022

ENGAGEMENT TYPE

- Service: Retail Investor Marketing

- Term: 4-month Campaign

- Client: Repeat Client

KEY METRICS

- Market Cap: Start $99.8mm / End $157mm

- Average weekly volumes*:

4-mo Pre: 124mm

During: 278mm

3-mo Post: 63k

Shares Outstanding: 37.89mm

Float: 13.4mm

*-Removed Single highest day from 4-mo. Pre & During Weekly Volumes

CAMPAIGN NOTES

- Retail Investor pre-uplisting preparation proved to affect unique views and marketing engagement significantly.

- Press Releases: 2x/mo., Low to Med Engagement

- Working closely with IR Firm on PR:No

CASE STUDY # 2 CAMPAIGN CHART

Case Study #3

ABOUT CLIENT

- Industry: FinTech

- Exchange: NASDAQ [Symbol: email us for full casestudy]

- Size: Small-Cap

CAMPAIGN

- Type: High-Level

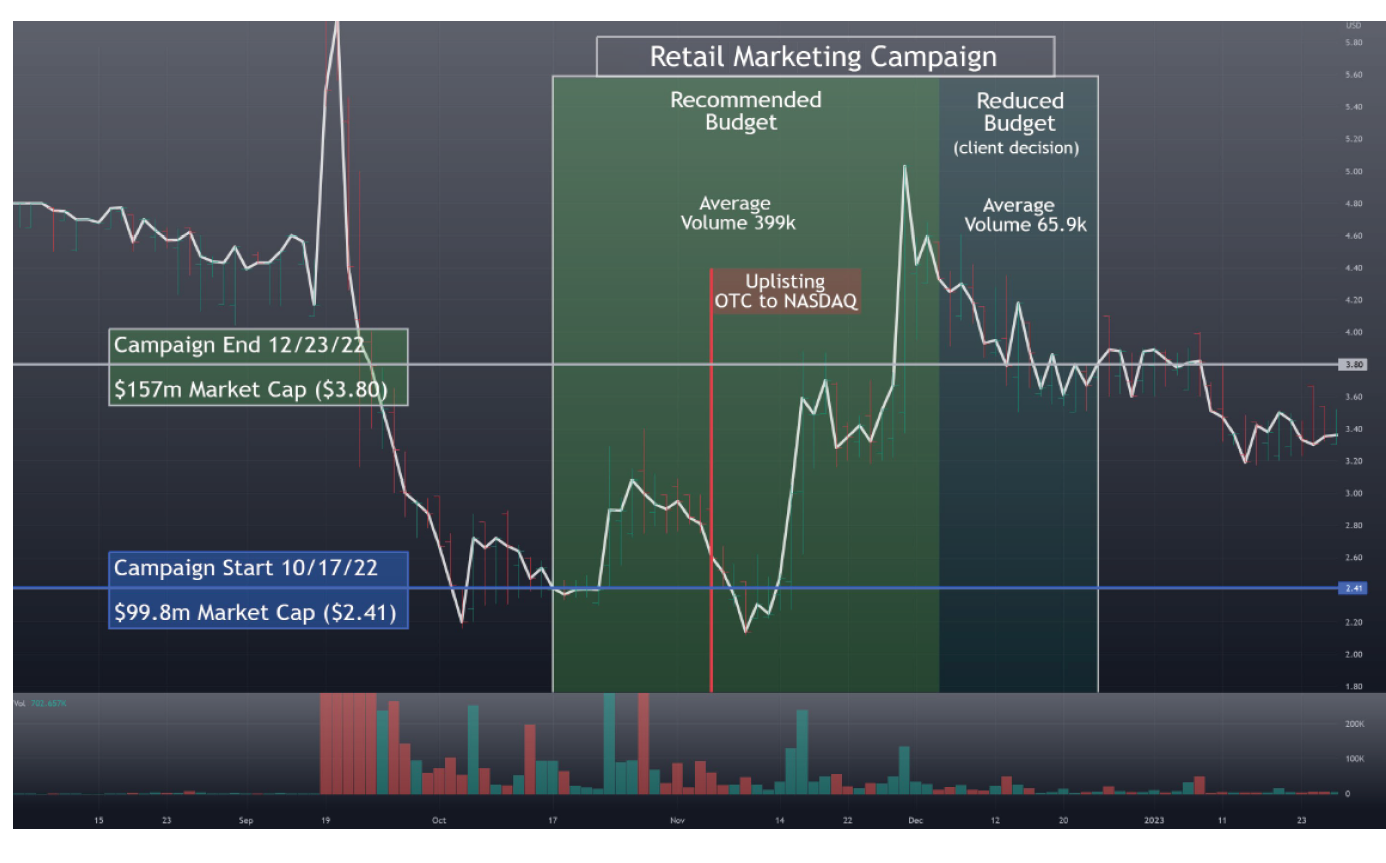

- Purpose: Pending Delisting (trading under $1.00)

- Ave Monthly Spend: $200k ($35k–$75k per wk)

- Campaign Span: Oct 18, 2022 – Dec 29, 2022

ENGAGEMENT TYPE

- Service: Equity Marketing

- Term: 3-month Contract

- Client: Repeat Client

KEY METRICS

- Market Cap: Start: $6.87mm / End $16.36mm

- Average weekly volumes*:

6-mo Pre: 15mm / During: 19.2mm

During: 278mm

3-mo Post: 63k

Shares Outstanding: 17.88mm

Float: 13.59mm

CAMPAIGN NOTES

- Company stock was at $0.60 (+/- $0.10) for four months previous to the start of the equity marketing campaign.

- Press Releases: 2x/mo., Low to Med Engagement

- Working closely with IR Firm on PR: Yes

- Social Sediment: Significant increase in Positive & Neutral comments, and in volume

CASE STUDY # 3 CAMPAIGN CHART